The theatre surrounding Apple’s manufacturing tussle between India and China got another twist this past week, courtesy of US President Donald Trump.

Trump’s recent pronouncements, essentially telling Tim Cook to ditch India as a manufacturing hub — “India can take care of themselves,” — sounded like his characteristic bluster to many.

Timed amid a 90-day US-China trade “truce” and ongoing US-India trade negotiations, Trump’s statements paint a complex picture. While Apple has stated that as far as its India manufacturing plans are concerned, Trump is not likely to like this answer.

The billion-dollar question: Is Trump genuinely pushing for an “Apple: Made in America” renaissance, or is India merely a pawn in his larger geopolitical game, potentially being nudged out as Apple is implicitly steered back towards China, at least for the interim.

Let’s unpack this. But after a look at the top stories from our newsroom this week:

- CleverTap started exploring the AI opportunity more than a decade back to sync consumer preferences with messaging and offers from brands, so does this give the company a leg-up in the GenAI race as SaaS platforms look to transform?

- Major B2B ecommerce players have been forced to do a business reset amid slowed investments, blitzscaling and deployment of asset-heavy models, but ElasticRun is banking on a pivot to quick commerce supply chain to stand out

- : While tensions keep simmering between India and Pakistan, what stood out in the latest conflict was the use of hi-tech and indigenously-developed systems by India part of the Akashteer air defence system

For years, Apple’s diversification strategy – the much talked about “China+1” – saw India emerge as a shining beacon. Apple iPhones worth $22 Bn were assembled in India in FY25, a staggering 60% YoY jump, with $17.4 Bn exported.

Bernstein even projected India could account for 15-20% of total iPhone production by the end of 2025. This isn’t small by any metric; it’s a testament to India’s growing assembly prowess and Apple’s strategic de-risking.

In fact, Apple even got many of its contract manufacturers to India in the hope of recreating the full stack in India.

But Trump’s rhetoric throws a spanner in these smoothly whirring assembly lines. His core argument? High Indian tariffs. “I don’t want you building in India … because India is one of the highest tariff nations in the world,” he declared. This conveniently overlooks the on-ground nuances.

Ajay Srivastava from the Global Trade Research Initiative (GTRI) recently highlighted a crucial point: India’s actual gains from iPhone assembly are surprisingly limited. For a $1,000 iPhone, India’s share is less than $30. A significant chunk of even this meagre sum boomerangs back to Apple via the Production Linked Incentive (PLI) scheme.

“High-end tech companies like Apple often employ few domestic factory workers because most production is offshored. Bringing iPhone assembly home would create a rare opportunity to generate mass employment in the US at scale,” Srivastava said.

Moreover, at Apple’s behest, India has been lowering component tariffs, potentially undercutting domestic efforts to build a deeper supply chain. Srivastava’s stark assessment is that if Apple shifts its assembly outside India, it could actually be a good thing for India.

This seems counterintuitive until you consider his follow-up: losing shallow assembly lines might force India to invest in deeper manufacturing, such as semiconductor chips, displays, EVs, batteries, and beyond, which will automatically make the country an attractive destination for electronics manufacturing.

Is The US Even Ready?This is where the conversation needs to pivot, moving beyond mere assembly to genuine value addition. And perhaps this message was lost amid all the talk about how Apple is bringing its full production to India.

The on-ground reality of shifting sophisticated manufacturing isn’t simple. Trump’s vision of iPhones rolling off US assembly lines faces a colossal hurdle: cost.

Srivastava estimates that moving assembly to the US would catapult labor costs from roughly $290 per month per worker in India to $2,900 per month under the US’ minimum wages. The assembly cost per iPhone could skyrocket from $30 to $390, he claimed. Apple would then either swallow a profit cut from $450 to $60 per device or pass the buck to American consumers.

Tim Cook, a maestro of supply chain economics, knows this better than anyone, and in the past few years, Apple’s profits have grown purely because of its supply chain efficiencies. It’s not just Cook who has asserted that the US does not have enough skilled workers or supply chain infrastructure, even Apple cofounder Steve Jobs believed the same.

So, if not a full-scale US shift, what could Trump be pushing for?

The China FactorWith the US and China recently agreeing to a 90-day pause in their tariff war, and duties on Chinese imports to the US dropping, one might speculate if Trump is subtly nudging Apple to slow its China exodus, perhaps keeping options open for a gradual, politically palatable shift to the US later, effectively leapfrogging India in the grand scheme.

This is a move that Trump has used in the past: use a bilateral issue (such as US-India trade talks) to apply pressure on a global corporation for domestic political brownie points. In fact, he claimed to have used this negotiation tactic even to bring in the ceasefire between India and Pakistan, but he did not elaborate beyond that.

The US-India Subnational Innovation Competitiveness Index (SICI) by the Information Technology & Innovation Foundation (ITIF) about whether the US or India are best placed to make the most of the manufacturing opportunity, particularly for Apple.

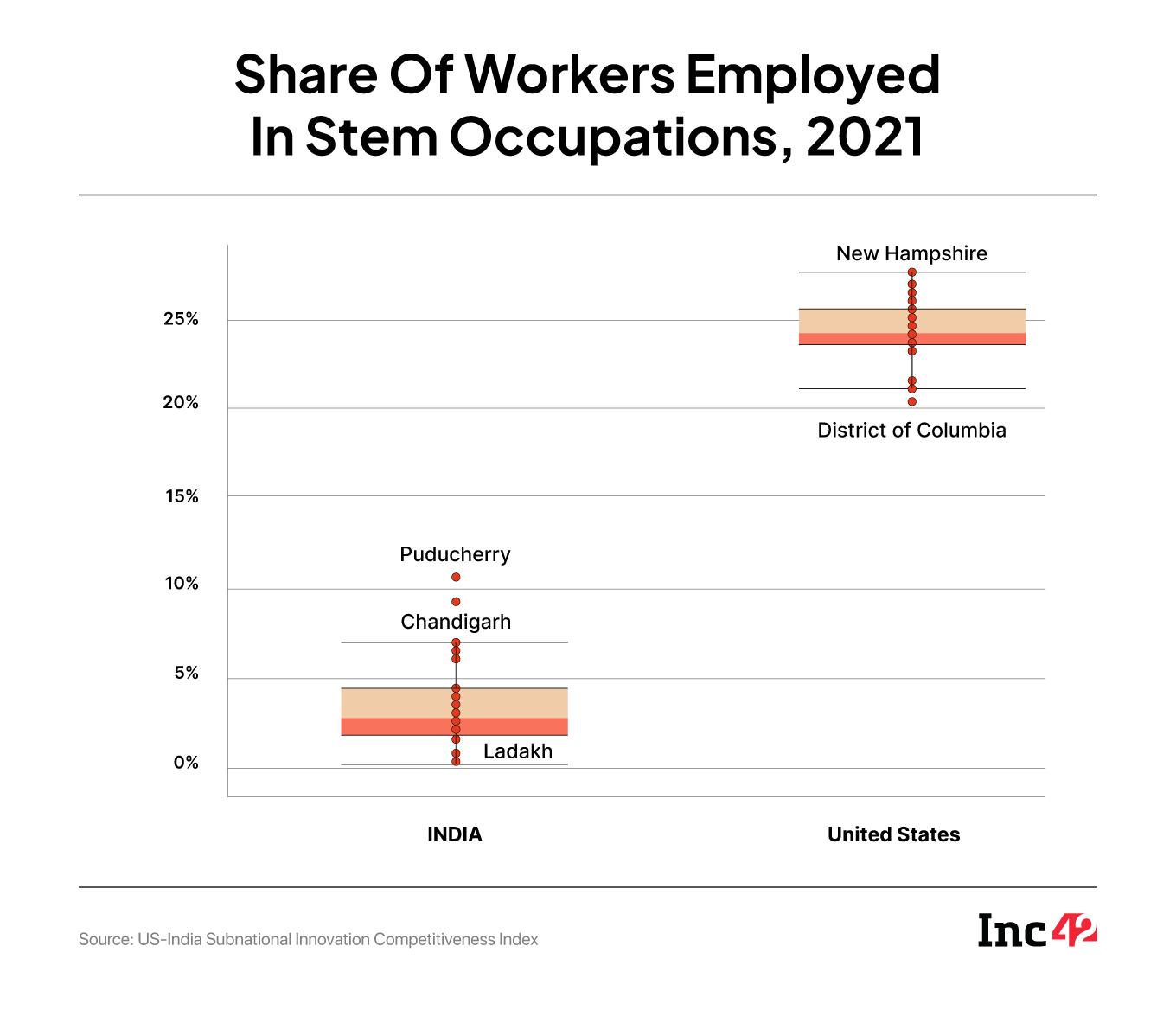

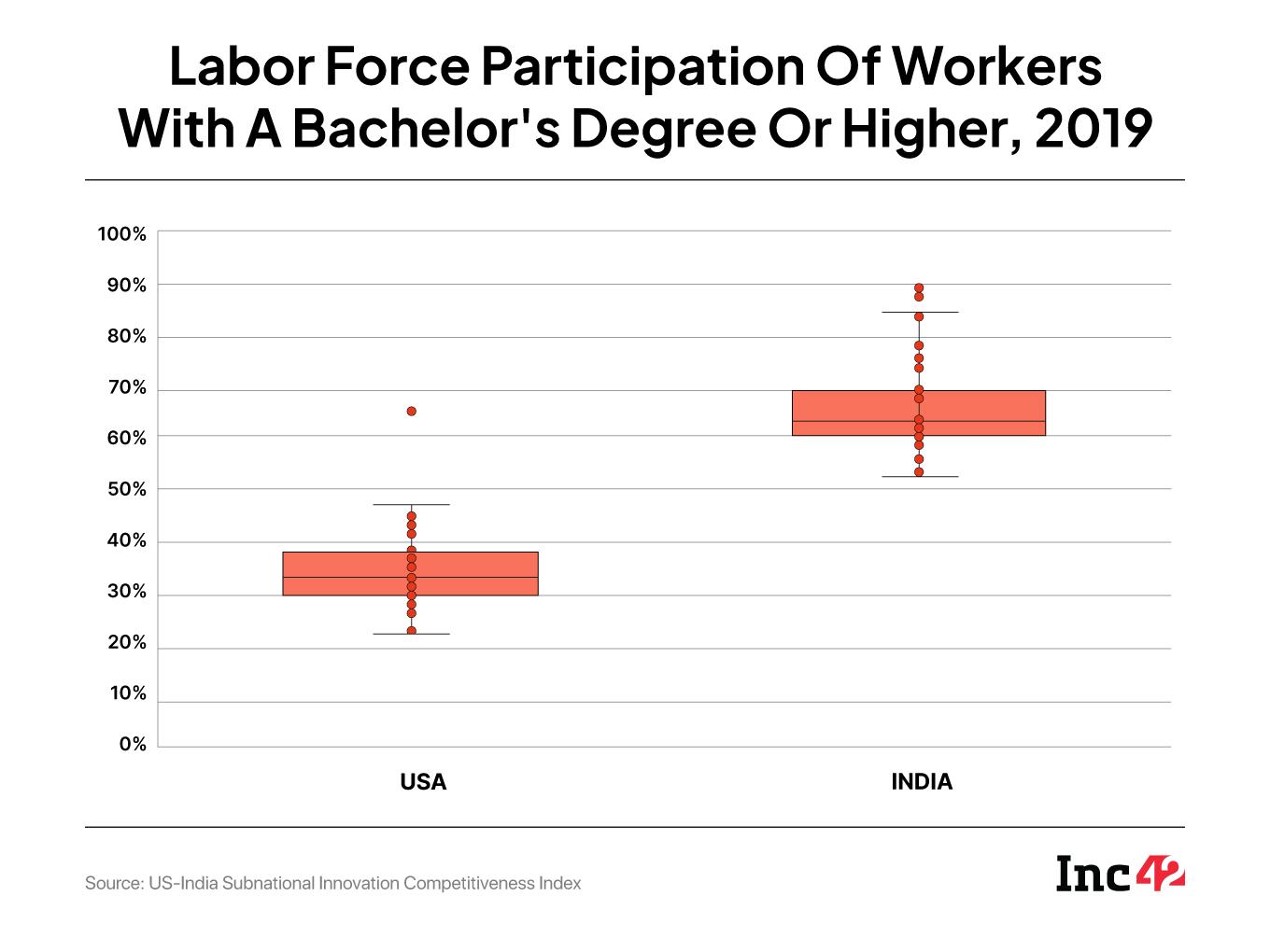

The SICI report underscores the chasm – and potential synergies – between the two nations. While India boasts the world’s highest number of STEM graduates, translating this into a potent, R&D-driven workforce is an ongoing battle.

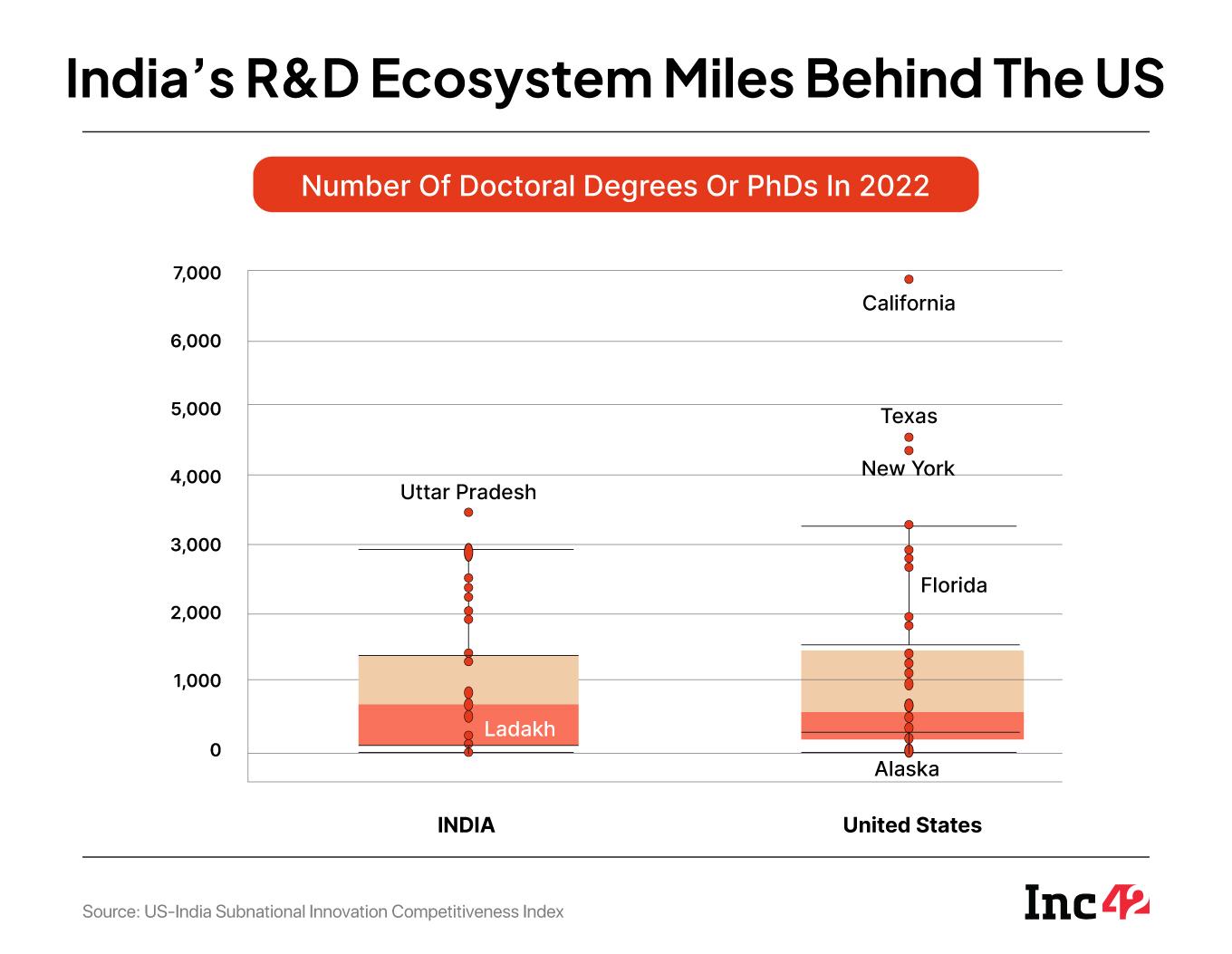

Data shows Indian states, even perceived leaders like Karnataka and Tamil Nadu, lag significantly in R&D personnel (less than 1% of the workforce in all states) and R&D intensity (all regions invest less than 0.5% of GDP). The private sector’s contribution to R&D in India is anaemic compared to the US, where it’s over 70%.

The SICI report points out that “for India, the priority lies in strengthening the innovative ecosystem at the subnational level by increasing R&D expenditures by the private sector, enhancing R&D intensity and patent intensity, investing in STEM education and workforce…”

This is the “deeper manufacturing” Srivastava referred to.

What Can India Do?While the US has its own challenges, its innovation hubs like California, Massachusetts, and Washington excel due to “targeted support for key industries, strong research institutions, and an emphasis on an entrepreneurship-based model.”

Another critical recommendation for India is to adopt the ‘Triple Helix Model’ or bring in collaboration between academia, industry, and the government.

Simply put, India needs to move beyond being a low-cost assembly destination to become an innovation partner. The 60,000 jobs Apple’s chain has created in India are valuable, but they are primarily in low-margin final assembly. China, by contrast, employs around 3 lakh workers in this segment.

Apple, for its part, has reportedly reassured the Indian government that its investment plans remain intact. This is a commercial entity navigating treacherous geopolitical waters. Its long-term strategy will likely involve continued diversification. But the depth and nature of its Indian engagement will depend on India’s ability to cultivate a robust innovation ecosystem.

Trump’s pronouncements, therefore, could be a misdirect, a negotiation tactic for the broader US-India trade deal, or a genuine, albeit economically challenging, desire to “bring jobs home.”

Regardless, for India, it’s a wake-up call. Relying on PLI schemes to prop up “shallow assembly lines” is a short-term game. The real win lies in fostering an environment where the next Nvidia, Qualcomm, Broadcom, or even a semiconductor fab, isn’t just operating but also innovating from India. The display of in the past week of India’s defence tech prowess, , is one example of how this can be taken forward.

The central government has to a joint venture between HCL and Foxconn to set up a semiconductor unit under the India Semiconductor Mission. The unit, which will see the two entities cumulatively invest INR 3,700 Cr, will come up near Uttar Pradesh’s Noida.

The path forward isn’t about reacting to every political gust from Washington. It’s about doubling down on building genuine innovative capacity – the kind that makes India an indispensable part of the global tech value chain, not just a low-cost stopover.

It’s only then can India be ready to take care of itself, as Trump was so convinced about this past week.

Sunday Roundup: Startup Funding, Deals & More

- Amid growing calls to boycott Turkey for its support to Pakistan amid the conflict with India, ecommerce players Myntra and Reliance-owned AJIO have reportedly stopped selling Turkish apparel brands

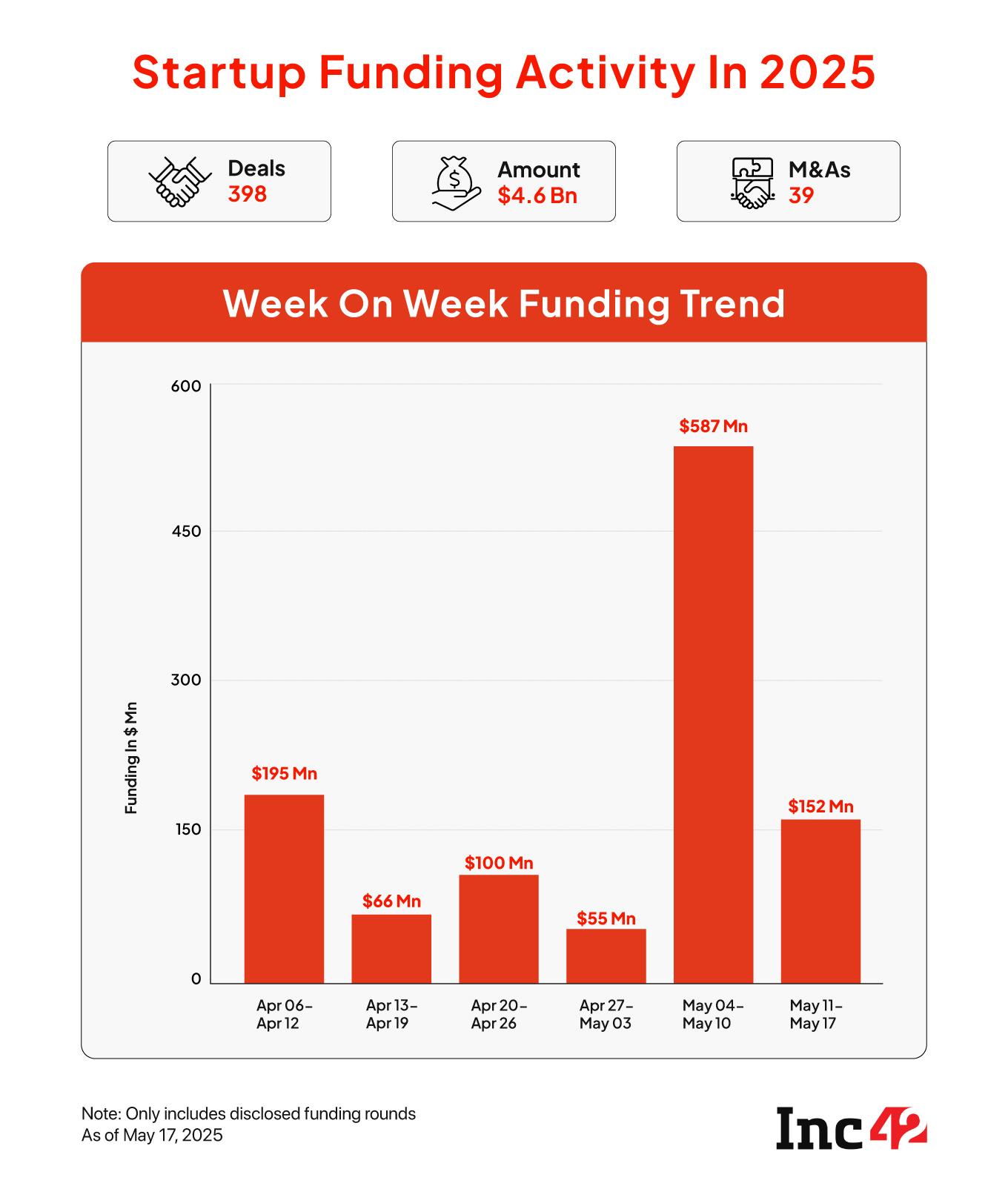

- Between May 12 and 17, startups cumulatively raised $151.6 Mn across 24 deals, marking a 74% decline from the $587 Mn raised by 27 startups in the previous week

- : The women-only community startup is halting its operations due to high customer acquisition costs and retention challenges. leap.club, which has raised $2.3 Mn to date, will shut its offline club in Mumbai’s Bandra and app by the end of this month

- IPO-bound investment tech unicorn Groww has signed a definitive agreement to acquire wealthtech startup Fisdom in a nearly $150 Mn all-cash deal, sources told Inc42

The post appeared first on .

You may also like

Extraordinary feat: Kharge remembers 'Smiling Buddha' India's first nuclear test

The huge lake in Africa that's one of the world's biggest and deadliest

EastEnders star Larry Lamb reveals update about his future on the soap

Squirrel as Pet: Tamil Nadu youngsters teach a lesson in compassion

New-Age Tech Stocks Gain $7 Bn Amid Broader Market Bull Run, Zaggle & ixigo Surge