VC firm Elevation Capital purchased more than 2.03 Lakh shares of IPO-bound portfolio startup Wakefit from the D2C brand’s employees via secondary transactions in 2025, ahead of it filing its DRHP.

As per Wakefit’s DRHP, the 2,03,426 shares were acquired at INR 1,600 each, translating into a total sum of INR 32.54 Cr.

The draft IPO documents also revealed that the VC firm bought more than 10.14 Lakh shares from cofounders, Ankit Garg and Chaitanya Ramalingegowda, and other former (including former CTO Kumar Gaurav) and current employees during the course of 2023. The shares were acquired at INR 1,152.86 each for a total consideration of nearly INR 117 Cr.

Meanwhile, the DRHP also revealed that the D2C brand allotted more than 26 Lakh shares (26,03,731 to be precise) to cofounders Garg and Ramalingegowda in May this year.

Interestingly, Elevation Capital is not participating in Wakefit’s offer for sale (OFS) component.

Wakefit Gears Up For IPOThe D2C furniture and mattress startup’s public issue will comprise a fresh issue of shares of up to INR 468 Cr and an OFS component of up to 5.8 Cr equity shares.

Wakefit’s promoters and cofounders, Garg and Ramalingegowda, as well as existing backers, including Peak XV Partners, Redwood Trust, Paramark, Verlinvest, among others, plan to offload their shares via the OFS.

The proceeds from the IPO will be utilised to expand its retail store footprint by setting up 117 new stores. A chunk of the capital will also be utilised for marketing initiatives.

Notably, Wakefit has been mulling IPO plans for a few months now. In April, the startup shortlisted Axis Capital, IIFL Capital Services and Nomura as bankers for its IPO. Subsequently, earlier this month, the Bengaluru-based D2C startup turned into a public entity and took the first step towards its public listing.

In the run up to its IPO, the company also appointed Arindam Paul, Alok Chandra Misra, Sandhya Pottigari, Gunender Kapur and Sudeep Nagar as independent directors to its board for a period of three years.

Founded in 2016, Wakefit sells a range of products such as mattresses, pillows, bed frames, mattress protectors, home decor and furniture. Competing with the likes of The Sleep Company, Duroflex, Kurlon and Sleepwell, Wakefit has raised more than $100 Mn in funding to date.

As per its DRHP, the startup earns 68.8% of its revenue from online channels, including its own website and ecommerce marketplaces. The remaining comes from its offline stores and multi-brand outlets. The company claims to offer more than 3,000 SKUs (stock keeping units).

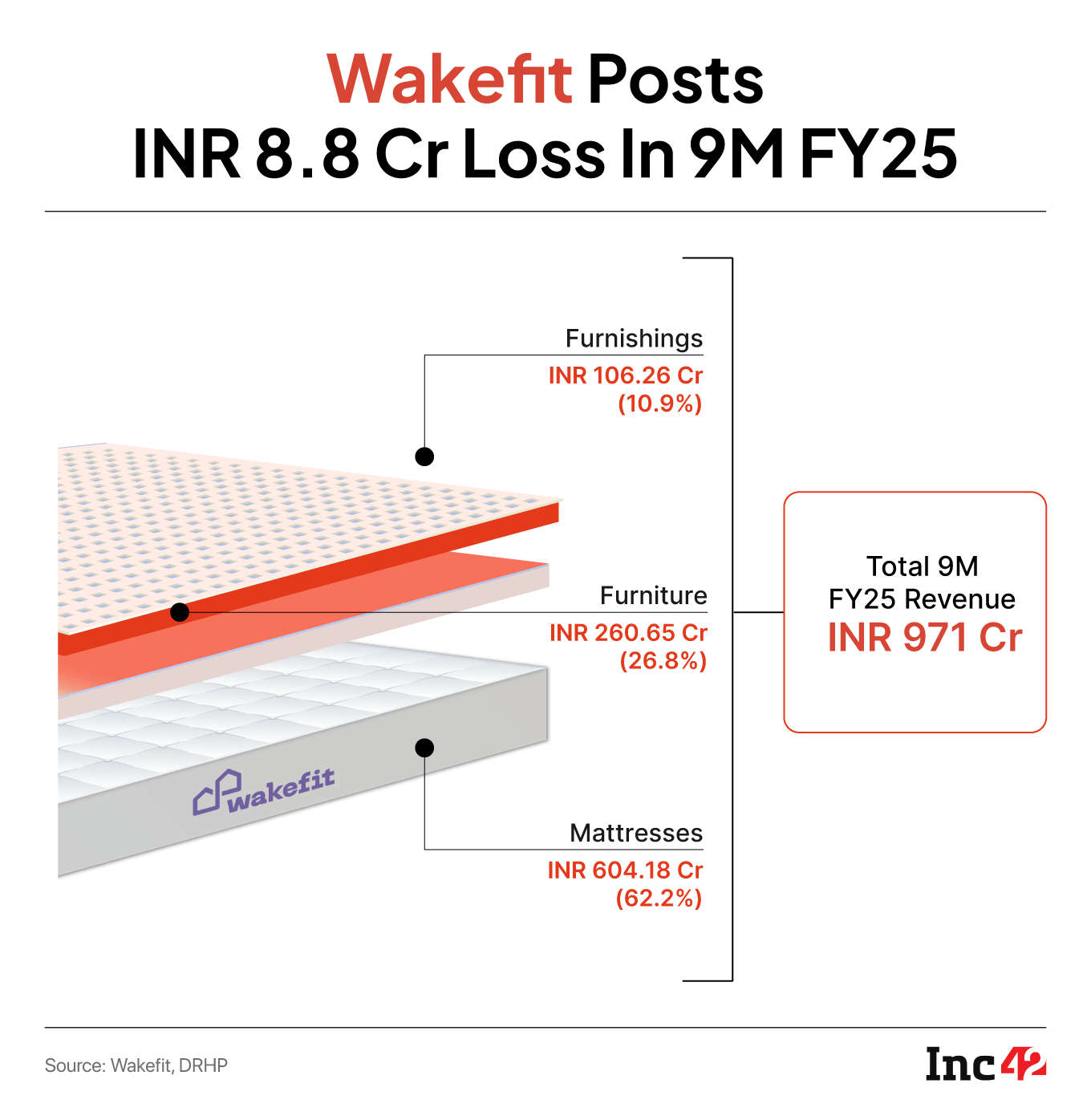

On the financial front, the IPO-bound startup reported a net loss of INR 8.8 Cr in the first nine months (9M) of the financial year 2024-25 (FY25) on an operating revenue of INR 971 Cr. Wakefit had clocked a net loss of INR 15 Cr in the full fiscal year FY24 on an operating revenue of INR 986.3 Cr.

The post Elevation Capital Bought 2.03 Lakh Shares Of Wakefit Ahead Of IPO appeared first on Inc42 Media.

You may also like

As CM, Uddhav accepted report saying Hindi compulsory, says Fadnavis

Indus Treaty arbitration court is illegal, says India

Brooklyn Beckham 'snubs' David Beckham after hospital dash amid family feud

Worldwide matcha craze causes shortage as Japanese tea farms strain to keep up with demand

Glastonbury fans complain over BBC's Rizzle Kicks snub after Jordan Stephens' message